2021 Giving Tax Incentives

A couple of key provisions of the CARES Act were extended into 2021, and in one case, increased. These include:

1. Increased Deduction for Individual Cash Donations: Up to 100% of adjusted gross income (AGI)

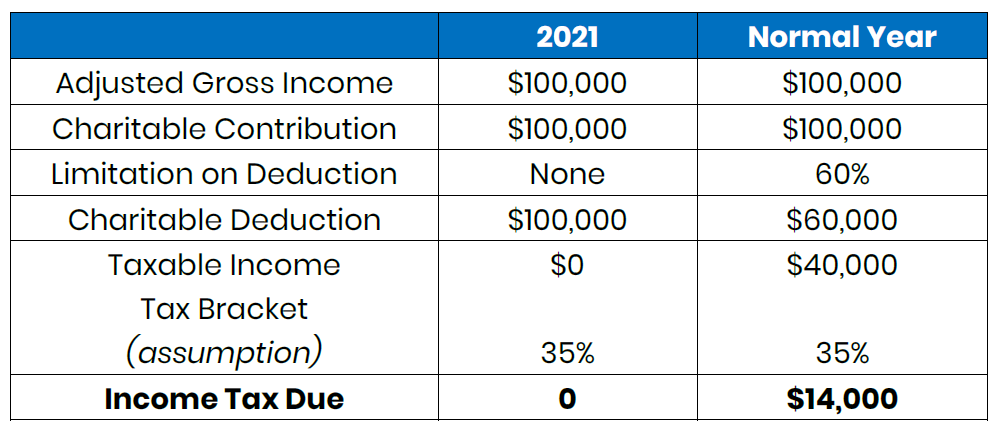

Normally, the deductions a taxpayer can claim for a charitable contribution is limited to 60% AGI. The CARES Act lifted that limitation, increasing it to 100% of AGI through 2021, meaning any individual filing an itemized return may donate the full amount of their AGI, leaving taxable income at $0 (see below example). Any excess contributions available can be carried over to the next five years. This increased deduction applies to gifts made to public charities, such as Judi’s House/JAG Institute.

2. Increased Deduction for Corporate Donations: Up to 25%

Much like the individual increase in percentage of the tax deduction, there has been an increase in the percentage corporations can deduct for charitable contributions. Corporations may deduct up to 25% of taxable income, up from the previous limit of 10%.

3. Non-itemized Tax Returns: “Universal Deduction” for Charitable Contribution

For taxpayers who do not itemize and file single/separately, this incentive adds a deduction of up to $300 (i.e. those who take a standard deduction). For 2021 only is an additional above-the-line deduction for those married filing jointly of up to $600 in cash contributions to charity. It is important to note that any donation above the limits (one-time or combined donations) will not qualify under this deduction incentive, and it only applies to cash gifts made in the year 2021.

This information is not intended as legal or tax advice. For such advice, please consult an attorney or tax advisor. Figures cited in any examples are for illustrative purposes only. References to tax rates include federal taxes only and are subject to change. State law may further impact your individual results.